DV SCHULDSCHEIN

The Schuldschein business is a German success story. In recent years, the market for corporate Schuldscheine has grown continuously and has become a key pillar in the financing spectrum of creditworthy companies in German-speaking countries. With the steadily increasing number of new market participants, the demands on coordination among the players – issuers, arrangers, and investors – are also increasing. DV Schuldschein, as a transaction platform, ensures structure, efficiency and transparency – and enables modern, seamless processing of the entire Schuldschein process in one place.

Actors

For whom is DV Schuldschein made?

Investors

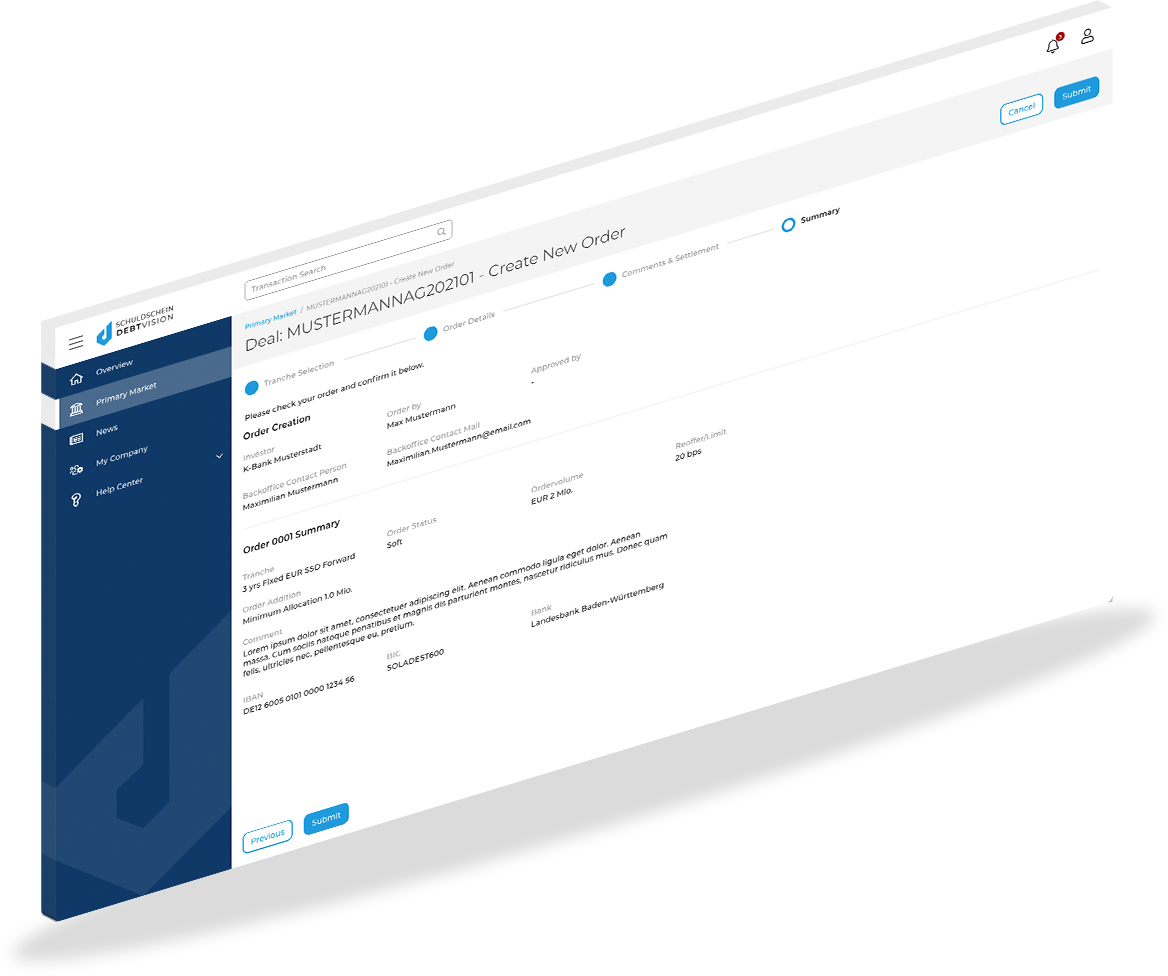

DV Schuldschein provides investors with a single point of information for new and existing transactions. The platform creates a new level of quality for the management of Schuldschein investments. Data is processed centrally, documents are provided in a structured manner, and the underwriting process is entirely digital – intuitive, transparent, and seamless.

Arrangers

DV Schuldschein increases the performance of the arranger consortium in marketing and the paying agent in the ongoing administration of transactions during the lifecycle.

Borrowers

DV Schuldschein increases convenience for borrowers throughout the entire marketing process and lifecycle. Communication with arrangers and investors takes place centrally via the platform – structured and transparent. A noticeable increase in transparency throughout the entire Schuldschein process..

Benefits For

Investors

Inform

For investors, the platform is a single point of information. Each transaction is centrally curated by the arrangers or the paying agent in consultation with the borrower: Transaction terms, financial documents, and contract documents are logically structured and can be found in seconds. The underwriting process is digital – intuitive, completely transparent, and seamless.

Invest

Investors place their soft and firm orders directly on the platform with just a few clicks – completely digitally. Questions about the transaction are addressed directly to arrangers and borrowers via the integrated communication room; all correspondence can be accessed for logging purposes. After the order book closes, the allocation, including final pricing, is immediately made available via the platform.

Manage

All Schuldschein investments are displayed in the clearly structured portfolio view until final repayment, including all coupon and repayment dates, remaining maturities, and repayments already made. Contract documents, annual financial statements, and research documents are available for retrieval and are automatically updated with new publications, ensuring all documents are always up to date. The integrated communications area provides a direct line to arrangers and borrowers; every message is filed chronologically and remains traceable. This allows investors to manage their entire Schuldschein portfolio transparently and without any media discontinuity.

Benefits For

Arrangers

Arrange

Before the marketing launch, DV Schuldschein enables convenient transaction structuring with the borrower. Depending on the transaction objectives, individual investor linking allows for a tailored approach. The central, digital order book displays order and volume trends in real time. Investors enter their orders independently. At the same time, arrangers have access to a communication room through which they can send information at any time: either to all investors or selectively to individual addresses. Updates, news, and documents reach the recipients directly.

Paying Agent services

With DV Schuldschein, paying agents rely on a powerful tool that not only provides optimal support for settlement after the order book closes, but also offers real added value throughout the entire lifecycle of the loan. DV Schuldschein enables settlement documents to be exchanged quickly, securely, and efficiently with investors and borrowers. The integrated communication room ensures maximum transparency and short communication channels. Even after settlement, DV Schuldschein ensures optimal networking. All participating investors can be reached with just a few clicks, and regular reporting documents are sent to their recipients in a targeted and professional manner.

Investor network

The successful marketing of a Schuldschein begins with the right approach to investors. DV Schuldschein has a powerful network of over 1,100 professional investors - including commercial banks, savings banks, cooperative banks and institutional investors such as insurance companies, pension funds and asset managers.

This network de facto represents the entire investor universe for corporate Schuldscheine. This means that potential investors can be identified in advance and invited to the transaction - for a tailor-made placement and the best possible marketing of the Schuldschein.

Benefits For

Borrowers

Keep an overview

Borrowers track every phase of the marketing process in real time. An intuitive transaction menu provides a structured overview of the transaction terms, the live order book, the marketing documents, and status updates from invited investors. The integrated communication room enables direct communication with arrangers and investors. This provides borrowers with a single point of information regarding their transaction and ensures they always have an up-to-date overview of which documents are still required and how the market is reacting – completely transparently, without email chaos or repeated follow-ups.

Even during the lifecycle of the Schuldschein, borrowers with DV Schuldschein maintain an overview of their Schuldschein.

Marketing success

The live order book shows at a glance which investors are interested and the amount of subscriptions to the offered tranches. Based on this information, marketing activities are managed in collaboration with the arrangers, and targeted updates are sent to selected investors via the communication room as needed. This ensures that marketing remains transparent at all times, can be quickly adapted, and is optimally aligned with the marketing objective.

Creditor Relations

DV Schuldschein enables complete transparency about the investors in all transactions and the ability to contact them at any time via the platform. Ongoing information is provided securely via the platform.

Measure us by our successes

Standard in the Schuldschein market

above

1.100

Satisfied investors

above

€55 billion

Transaction volume under management

above

12.500

Schuldschein investments

above

350

Transactions

Three steps to your access

1.

Apply for access to DV Schuldschein using our registration form.

2.

The DEBTVISION team will process your request and contact you.

3.

The onboarding of your company and employees can begin. Our service team will support you.

Apply for your free access today and take advantage of DV Schuldschein.